Diving into the world of insurance premium calculation, where costs are determined by various factors, this topic sheds light on the intricacies of how premiums are calculated. From demographics to deductibles, get ready to uncover the secrets behind your insurance costs.

Exploring the realm of insurance premium calculation reveals the complex web of elements that contribute to the final cost of your coverage.

Overview of Insurance Premium Calculation

Insurance premium calculation is the process of determining the amount of money an individual or business needs to pay for an insurance policy. It is crucial to accurately calculate insurance premiums to ensure that policyholders are adequately covered for potential risks while also maintaining the financial stability of the insurance company.

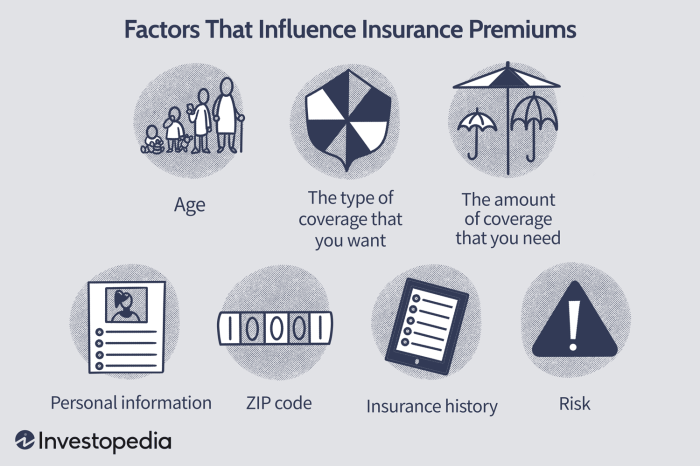

Factors Influencing Insurance Premium Calculations

- The type of insurance policy: Different types of insurance, such as life insurance, health insurance, auto insurance, and property insurance, have varying factors that influence premium calculations.

- Age and health status: For health and life insurance, age and health status are significant factors that affect premium rates. Younger and healthier individuals typically pay lower premiums.

- Location and environment: The location of a property or individual can impact insurance premiums. For example, homes in high-risk areas for natural disasters may have higher premiums.

- Claims history: A person’s history of filing insurance claims can also affect premium calculations. Individuals with a history of frequent claims may face higher premiums.

- Coverage limits and deductibles: The level of coverage and deductibles chosen by the policyholder can impact premium rates. Higher coverage limits and lower deductibles usually result in higher premiums.

Examples of Insurance Premium Calculations Across Policies

- Auto Insurance: Premiums for auto insurance policies are influenced by factors such as the driver’s age, driving record, type of vehicle, and coverage options.

- Health Insurance: Premiums for health insurance are determined based on factors like age, pre-existing conditions, and the level of coverage selected.

- Property Insurance: Homeowners insurance premiums are affected by the location of the property, the age of the home, security features, and coverage limits.

Factors Considered in Insurance Premium Calculation

Insurance companies take into account several factors when calculating premiums to determine the cost of coverage for policyholders. These factors can vary depending on the type of insurance and the individual’s risk profile.

Demographics, Location, and Risk Assessment

When calculating insurance premiums, companies consider demographics such as age, gender, marital status, and occupation. Younger drivers, for example, may pay higher premiums for auto insurance due to their higher risk of accidents. Location also plays a significant role, as areas prone to natural disasters or high crime rates may lead to higher premiums. Risk assessment involves evaluating an individual’s likelihood of filing a claim based on various factors like credit score, driving record, and health status.

Deductibles, Coverage Limits, and Policy Types

Deductibles are the amount policyholders must pay out of pocket before insurance coverage kicks in. Higher deductibles typically result in lower premiums, as individuals assume more financial responsibility. Coverage limits determine the maximum amount an insurance company will pay for a claim. Policy types, such as comprehensive or liability coverage, also influence premium costs based on the level of protection provided.

Examples of Variations in Premium Costs

For example, two individuals of the same age and gender may have different premium costs if one has a history of traffic violations and the other has a clean driving record. Similarly, a homeowner in a flood-prone area may pay higher premiums for property insurance compared to someone in a low-risk zone. Factors like the value of assets insured, previous claims history, and desired coverage levels all contribute to variations in insurance premium calculations.

Methods Used for Insurance Premium Calculation

Insurance companies use various methods and algorithms to calculate premiums, taking into account factors like the policyholder’s age, location, driving record, and more. Let’s explore some of the common methods used in premium calculation.

Data Analytics and Actuarial Science

Data analytics and actuarial science play a crucial role in insurance premium calculations. Actuaries use complex mathematical models and statistical techniques to analyze data and predict risk. By studying historical data and trends, insurance companies can accurately assess the likelihood of claims and determine the appropriate premium to charge.

Underwriting Process

The underwriting process is another key factor in premium pricing. Underwriters evaluate the risk associated with insuring a particular individual or entity. They consider various factors such as health history, occupation, lifestyle, and more to determine the level of risk involved. Based on this assessment, the premium is adjusted accordingly to reflect the risk level.

Advancements in Technology

Advancements in technology have revolutionized the way insurance premiums are calculated. With the use of big data analytics, machine learning, and artificial intelligence, insurance companies can now process vast amounts of data quickly and accurately. This allows for more personalized pricing based on individual risk profiles, leading to fairer and more competitive premiums in the market.

Transparency and Regulation in Insurance Premium Calculation

Transparency in insurance premium calculations is crucial for ensuring that consumers understand how their premiums are determined. By providing clear information on the factors considered and methods used, insurance companies can build trust with their policyholders. Regulations play a key role in governing how insurance premiums are calculated, ensuring fairness and preventing discrimination in pricing.

Importance of Transparency, Insurance premium calculation

Transparency in insurance premium calculation allows consumers to make informed decisions when purchasing insurance policies. By disclosing the factors that influence premium rates, such as age, driving record, and coverage limits, insurance companies help consumers understand the value they are receiving for their premium payments.

Regulations in Premium Calculation

- Insurance regulators set guidelines for how insurance premiums can be calculated, ensuring that companies use fair and non-discriminatory practices.

- Regulations may require insurers to justify rate increases and provide detailed explanations to policyholders.

- Regulators also monitor insurance companies to prevent deceptive practices and ensure compliance with laws.

Impact on Industry and Consumers

- Transparency and regulation in insurance premium calculation promote competition by allowing consumers to compare rates and coverage options from different insurers.

- Consumers are more likely to trust insurance companies that are transparent about their pricing methods and adhere to regulatory standards.

- Regulations that promote fairness in premium calculation help protect consumers from being unfairly charged based on factors such as gender or ethnicity.